BUS2235 INTRODUCTION TO FINANCE-SEMESTER 2, 2025/2026 DBAO

Class

The study of this course will provide students with a strong foundation in finance that allows them to understand and apply the concepts in the world of finance as well as to focus their attention to certain issues they can further explore. It introduces students into modern method of managing finance both on personal and firm level. These financial theories can be applied in everyday life, financial management and investment.

This course is designed to cater students with an initial exposure of finance which applicable for both in personal and managerial finance. At the end of the course students are able to recognize relationship between finance and other business disciplines, as well as to be able to use synergy of those disciplines in decision making.

.png?lmsauth=60d2e68430f6e401acc1f012d166500e99750d9c)

.png?lmsauth=94f8941b905f11e4e2d1b898037ed625df875af7)

Here is the class outline:

1. TOPIC 1: INTRODUCTION TO FINANCIAL MANAGEMENT

Nov 26

CLO1. Explain the goal of the firm and the various legal forms of business organisation. • Finance: A quick look • Business finance and financial manager • Forms of business organizations • The goals of financial management • Agency problem 2 sections

|

||

|

2. TOPIC 2: FINANCIAL STATEMENT ANALYSIS

Nov 27

CLO2. Compute financial ratio analysis to evaluate a company’s performance and prepare pro forma financial statement and cash budget for financial planning. • Understanding financial statements • Ratio analysis: o Standardized financial statements o Types of ratios 1 section

|

|

|

3. TOPIC 3: FINANCIAL PLANNING AND BUDGETING

Dec 3

CLO2. Compute financial ratio analysis to evaluate a company’s performance and prepare pro forma financial statement and cash budget for financial planning. • Introduction • Sales forecast • Pro-forma of financial statements • Introduction to short term financial planning o Cash budgeting 2 sections

|

||

|

4. TOPIC 4: TIME VALUE OF MONEY

Dec 10

CLO3. Demonstrate the concept of the time value of money and discover various financial decision making techniques. • Introduction • Interest o Compound interest o Simple interest • Present value • Future value • Annuity o Ordinary Annuity o Annuity Due o Perpetuity 1 section

|

|

|

5. TOPIC 5: RETURNS AND RISKS

Dec 26

CLO2. Apply financial management concepts and tools to the investment decisions. (C3) At the end of this topic, students should be able to: 1. Explain the concept of risk and return 2. Determine the relationship between risk and return 3. Calculate the required rate of return, risk level (standard deviation) and coefficient variation (volatility of risk) for securities 4. Relate which investment proposal is viable based on the measured risk and return 5. Identify the types of risk and relationship between risk and return 3 sections

|

|||

|

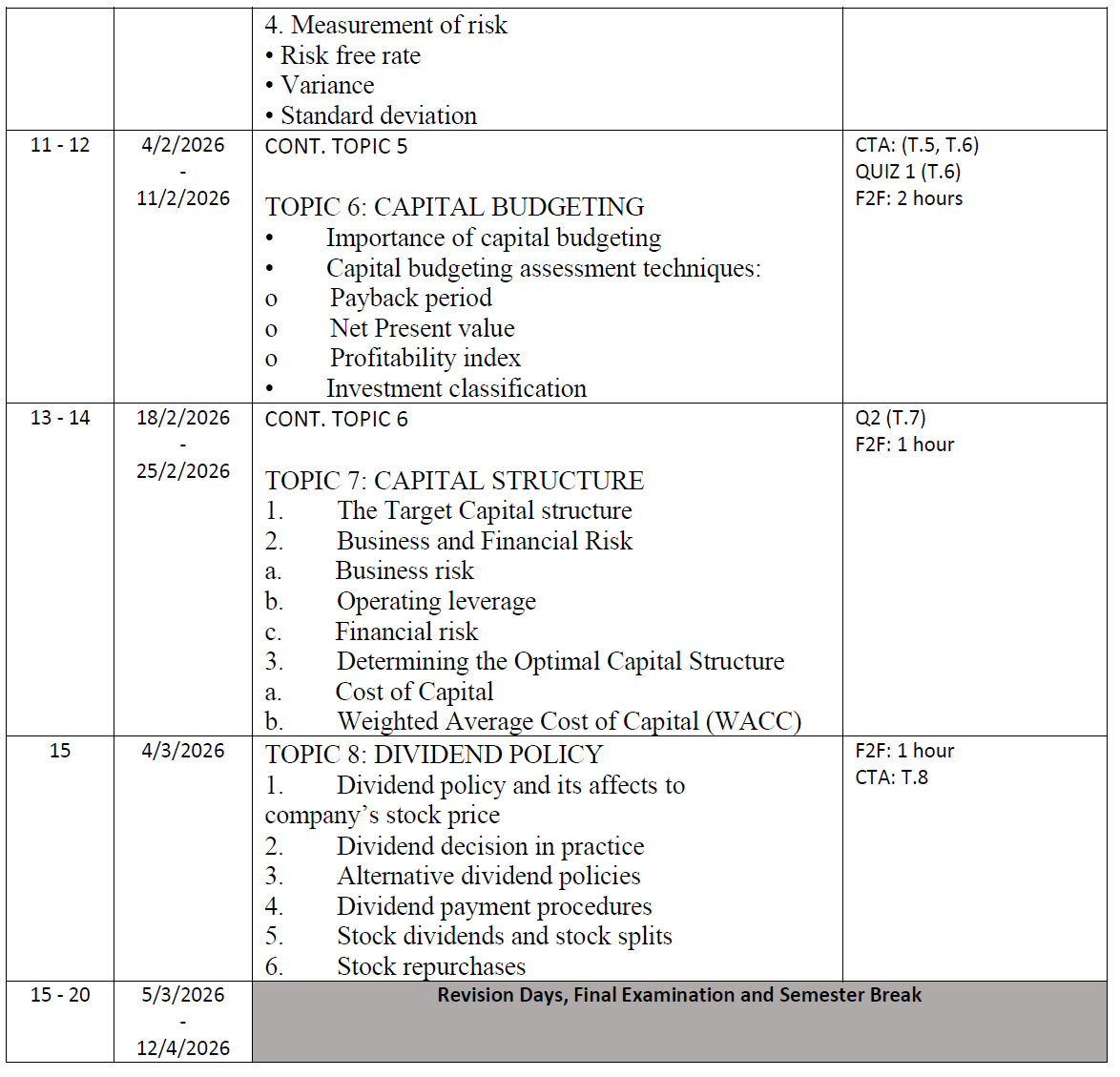

6. TOPIC 6: CAPITAL BUDGETING

Jan 7

CLO2. Apply financial management concepts and tools to the investment decisions. (C3) • Importance of capital budgeting • Capital budgeting assessment techniques: o Payback period o Net Present value o Profitability index • Investment classification 2 sections

|

||

|

7. TOPIC 7: CAPITAL STRUCTURE

Jan 21

CLO3. Apply financial management concepts and tools to the financing and dividend decisions. (C3) • Cost of Common Stock • Cost of Preferred Stock • Weighted Average Cost of Capital 2 sections

|

||

|

8. TOPIC 8: DIVIDEND POLICYDividend policy and its affects to company’s stock price 2. Dividend decision in practice 3. Alternative dividend policies 4. Dividend payment procedures 5. Stock dividends and stock splits 6. Stock repurchases 6 sections

|

||||||

|

(2).png?lmsauth=3cb7682b0a533780c6abc87b2b5791a2cd7a7ace)

(3).png?lmsauth=53f59a3eff4c42f64959607fcaecdc3482d82cbd)